One topic that many people worry about continually is money. It’s common to think about how much money we have or don’t have as well as how we’re going to keep our family afloat. In a perfect world, everyone would have enough money to live comfortably, but that’s not reality. Even though the economy is doing well, a large portion of the country is struggling. Many people don’t have extra income that can be put away for the future.

Although people want to be comfortable in their daily lives, it can be hard to make ends meet, especially when emergencies arise. There are steps to take to keep more money saved so that people can afford to treat themselves or have money for a rainy day. There’s never a wrong time to start saving money for the future for yourself and your family. Here are 40 of the easiest ways people can start saving money. Which methods are you willing to try?

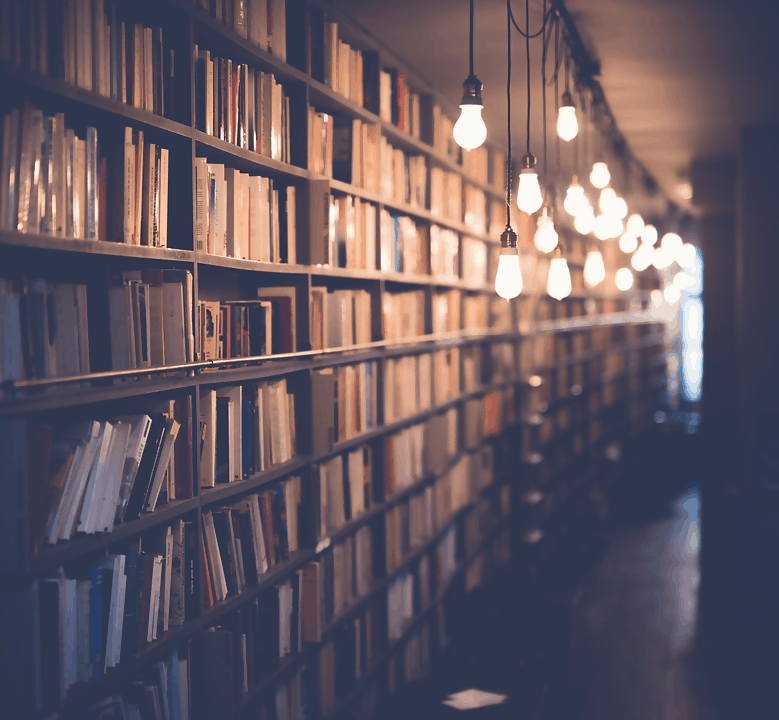

1. Head to the Library

Hankering to read a new book? Don’t go to the bookstore, opt for a library instead. It’s much cheaper to use a library card than having to buy a new book. And there won’t be a home filled with clutter from all the books that have been purchased either. If they don’t have a particular book, it isn’t hard to make a request from the library to search for it either. They can contact other libraries to have it shipped to them to borrow.

The library is also a great place to find music, movies, and even video games. It’s an ideal place to take your whole family for a chance to have fun and learn something new. The best part about the library is that everything is free to access.