Nearly everybody dreams of one day becoming rich. Young adults often attempt to find the fulfillment of that dream by chasing the perfect job and the illusion of success. Unfortunately, people are guided by a culture that values the latest self-made multi-millionaire, even if that sudden wealth means they became tycoons via unethical means. Moreover, when that wealth vanishes overnight, the media pounces on the disgraced millionaire or billionaire.

There are many who were in yesterday’s Fortune 500 are now in jail or facing lifetimes of ignominy. Furthermore, take their failures as a lesson. It may be best if you value the integrity of the people around you more than the fast and glitzy life of those who seem to be overnight successes. Read ahead to see how 25 business tycoons destroyed their own empires according to How They Blew It by Jamie Oliver and Tony Goodwin.

25. Jocelyn Wildenstein

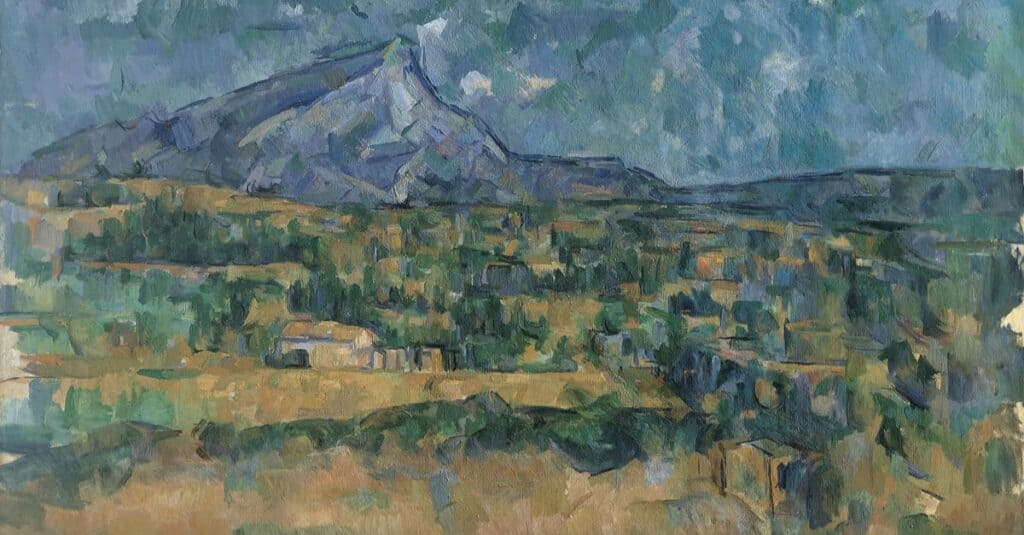

Wildenstein was once worth billions of dollars due to her marriage to billionaire art dealer Alec Wildenstein. Wildenstein was a New York socialite who lived the lavish life of a billionaire in every way possible; parties, luxury homes, extensive cosmetic surgery, and more. However, when she and Alec Wildenstein divorced, her luxury lifestyle quickly collapsed. She spent the entire sum of more than 2.5 billion she received in a divorce settlement and had to turn to two pieces of supposedly priceless art for support. However, it turned out the Diego Velazquez painting was a forgery, and the Paul Cezanne she was given sold for far less than it was appraised for.

When Wildenstein filed for Chapter 11 bankruptcy in 2019, she reported that she had $0 in her checking account. Her only source of income was $900 per month in Social Security payments and assistance from friends and family. Despite her newfound poverty, she was still able to retain expert legal aid and is seeking more assets from her billionaire ex-husband to achieve what, in her words, she feels she deserves for her lifetime. A judge has stipulated she cannot use any further payments from her husband’s estate for additional cosmetic surgery, thanks to her shocking appearance that has led her to be called “Catwoman” and the “Bride of Wildenstein.”